Introduction:

When it comes to building long-term wealth, diversification is one of the most important strategies you can employ. A diversified investment portfolio not only helps reduce risk but also positions you to take advantage of different market opportunities. Whether you’re new to investing or looking to optimize your current portfolio, this guide will walk you through everything you need to know about building and maintaining a diversified investment portfolio.

By diversifying your assets across different asset classes, industries, and geographical regions, you can achieve a balanced portfolio that withstands market volatility while providing sustainable growth. In this blog post, we will cover the basics of portfolio diversification, its benefits, different asset classes to include, strategies to balance risk, and tips for rebalancing your portfolio over time.

1. What is portfolio diversification?

Diversification is the practice of spreading your investments across various financial instruments, asset classes, and sectors to reduce exposure to any single risk. The goal is to create a portfolio that contains a mix of investments that will perform well under different market conditions. When one investment performs poorly, another might perform better, balancing out the overall risk.

For example, a portfolio that only consists of stocks from a single industry, such as technology, is highly susceptible to losses if that industry faces challenges. On the other hand, a portfolio with a mix of stocks, bonds, and real estate investments will be better protected in times of economic uncertainty.

Why is Diversification Important?

Diversification is essential because it helps investors avoid the risks associated with “putting all their eggs in one basket.” By spreading your investments, you decrease the impact of a single asset’s poor performance on your overall portfolio. Here’s why diversification is critical:

- Risk Reduction: A diversified portfolio reduces exposure to the negative performance of one asset or market sector.

- Increased Potential for Returns: Different assets perform well in different market conditions, which can boost the overall return of your portfolio.

- Market Volatility Protection: Diversified portfolios are more stable because gains in one asset class can offset losses in another during market turbulence.

2. The Different Types of Asset Classes for Diversification

To effectively diversify your portfolio, it’s essential to understand the main asset classes available to investors. Each class has its own risk and reward profile, and including a mix can provide the balance you need.

Stocks (Equities)

Stocks represent ownership in a company, and they offer the potential for high returns but come with higher risk. Stock prices can be volatile, especially over the short term. However, over the long term, stocks tend to outperform other asset classes, making them a critical component of a diversified portfolio.

Domestic vs. international stocks: Including both domestic and international stocks helps diversify your exposure to economic conditions in different regions.

Large-Cap, Mid-Cap, and Small-Cap Stocks: Large-cap stocks are generally less risky, while mid-cap and small-cap stocks can offer higher growth potential but come with increased risk.

Bonds (Fixed Income)

Bonds are debt securities where you lend money to a corporation or government in exchange for regular interest payments and the return of the principal amount when the bond matures. Bonds tend to be less volatile than stocks and provide a steady income, making them ideal for reducing risk in a portfolio.

- Government Bonds: Typically safer than corporate bonds, but offer lower yields.

- Corporate Bonds: Higher yield than government bonds, but with slightly more risk.

- Municipal Bonds: Issued by local governments, these can be tax-exempt and are considered lower risk.

Real Estate

Real estate investments offer diversification through physical assets that generate rental income and can appreciate in value. Real estate tends to be less correlated with the stock market, providing a hedge against stock market volatility.

- Direct Real Estate: Buying physical property, such as rental homes or commercial real estate, can offer substantial returns but also requires management and upkeep.

- Real Estate Investment Trusts (REITs): REITs allow investors to pool their money to invest in real estate portfolios, providing a more hands-off approach to real estate investing.

Commodities

Commodities are physical goods such as gold, oil, or agricultural products. Commodities often move in the opposite direction of stocks and bonds, making them useful for diversification. They also provide a hedge against inflation since their prices tend to rise when inflation increases.

- Precious Metals: Gold and silver are popular commodities for hedging against market downturns.

- Energy: Oil and natural gas are volatile but can provide substantial returns.

- Agriculture: crops, livestock, and other agricultural products can offer diversification, especially in inflationary periods.

3. How to Build a Diversified Portfolio

Now that you understand the different asset classes, let’s talk about how to construct a diversified portfolio. The right mix of assets depends on your financial goals, risk tolerance, and investment horizon.

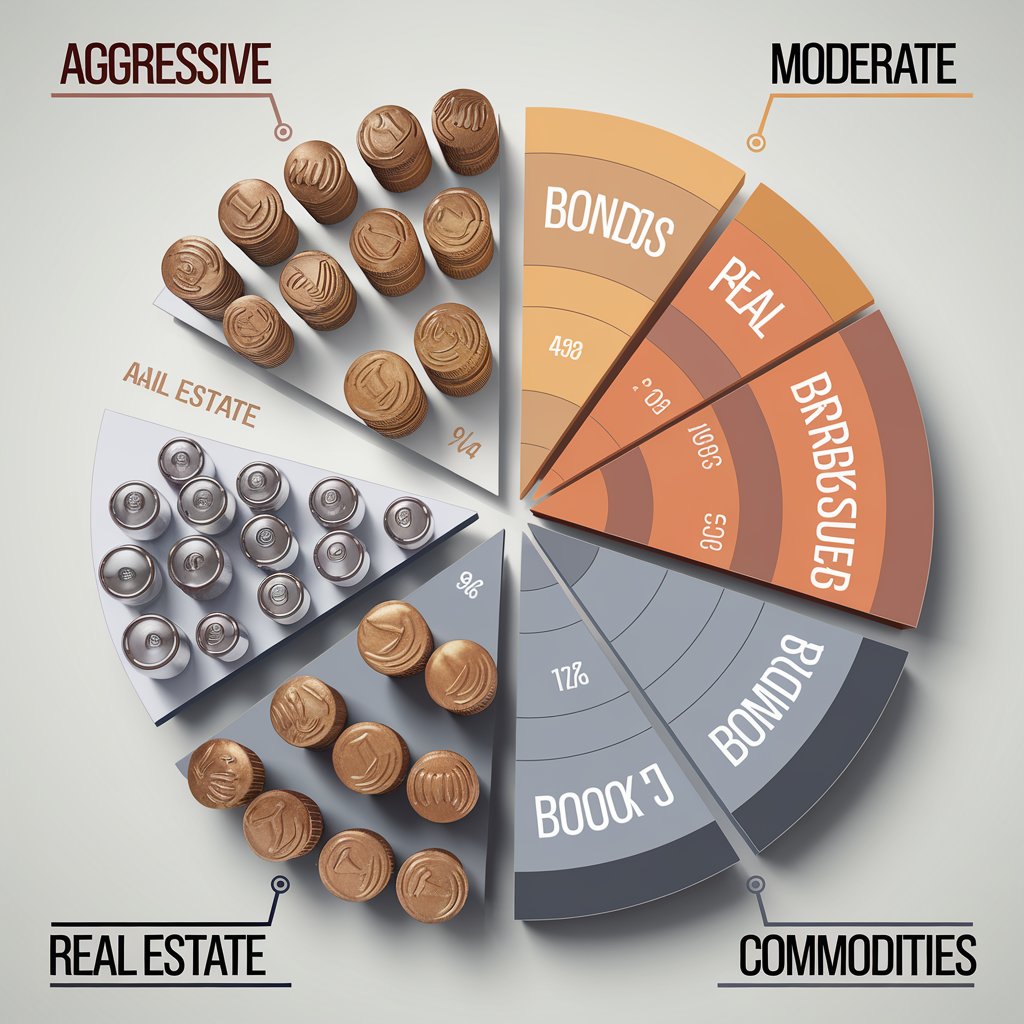

Step 1: Determine Your Risk Tolerance

Risk tolerance is your ability to endure the ups and downs of the market. Some investors are comfortable with volatility if it means higher potential returns, while others prefer more stability even if it means lower returns.

- Aggressive Investors: May allocate more of their portfolio to stocks, especially growth-oriented and international stocks.

- Moderate Investors: Typically maintain a balance between stocks and bonds, with a mix of higher-risk assets and safer investments.

- Conservative Investors: Focus more on bonds, real estate, and other low-risk investments, aiming for stability and preservation of capital.

Step 2: Choose Asset Classes for Diversification

Once you’ve determined your risk tolerance, you can decide how to allocate your investments across the various asset classes. A diversified portfolio might include:

- 60% Stocks (a mix of domestic, international, large-cap, and small-cap)

- 30% Bonds (a mix of government, corporate, and municipal bonds)

- 5% Real Estate (through REITs or direct real estate investments)

- 5% Commodities (such as gold or agricultural products)

This is just one example; your exact allocation should be tailored to your individual goals and risk profile.

Step 3: Rebalance Regularly

Your portfolio won’t maintain the same asset allocation over time. As the value of your assets changes, your portfolio will drift from its original allocation. Rebalancing ensures your portfolio stays aligned with your risk tolerance and investment strategy.

You can rebalance your portfolio by either selling off assets that have grown too large and reinvesting in those that are underrepresented or by adding new contributions to the underrepresented asset classes.

- Time-Based Rebalancing: Review and rebalance your portfolio at regular intervals (e.g., annually or quarterly).

- Threshold-Based Rebalancing: Rebalance when an asset class deviates by a certain percentage from your target allocation.

4. Strategies to Diversify Beyond Traditional Asset Classes

While traditional asset classes like stocks and bonds form the backbone of most portfolios, other investment strategies can enhance diversification:

Alternative Investments

Alternative investments include private equity, hedge funds, collectibles (like art), and cryptocurrencies. These assets tend to have low correlation with traditional asset classes, offering additional diversification.

- Private Equity: Involves investing in privately held companies. While potentially lucrative, private equity is often illiquid and riskier than public stocks.

- Hedge Funds: Pooled funds that use a variety of strategies, including short selling and leverage,

to generate returns.

- Cryptocurrencies: High-risk digital assets like Bitcoin and Ethereum that can provide enormous returns but come with extreme volatility.

Geographical Diversification

Investing in different regions of the world can provide protection from localized economic downturns. Consider adding emerging markets or developed markets outside the U.S. to your portfolio.

Conclusion

Creating a diversified investment portfolio is key to managing risk while maximizing returns. By allocating your investments across different asset classes, geographical regions, and sectors, you can create a portfolio that weathers market volatility while providing growth over the long term.

The strategies outlined in this guide—diversifying with stocks, bonds, real estate, commodities, and alternative investments—offer a roadmap to financial success. Remember to rebalance your portfolio regularly, stay informed about new investment opportunities, and adjust your strategy as your financial goals evolve.

Subscribe to Finance Savvy Spot for more expert tips on building a diversified investment portfolio and achieving financial independence!