How To Calculate Return On Investment And Help Project Your Retirement 2025

Calculating return on investment (ROI) and projecting your retirement savings are important steps in assessing financial performance and planning for the future. Here’s how to do both:

How To Calculate Return On Investment And Help Project Your Retirement 2025

1. How to Calculate ROI

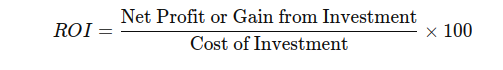

ROI measures the profitability of an investment, showing how much return you have made compared to the amount you invested. The basic ROI formula is:

Steps to Calculate ROI:

- Step 1: Determine your investment’s initial cost. This includes the money spent to acquire the investment, any fees, or related costs.

- Step 2: Calculate the total returns or profits you made from the investment (selling price, dividends, etc.).

- Step 3: Subtract the initial cost from the returns to get the net profit.

- Step 4: Divide the net profit by the initial cost of the investment.

- Step 5: Multiply the result by 100 to get the ROI percentage.

Example:

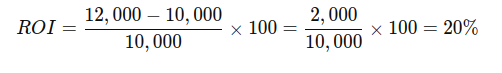

If you invested $10,000 in stocks and the total value increased to $12,000, your ROI would be:

This means you earned a 20% return on your initial investment.

2. How to Project Your Retirement

Projecting your retirement savings requires estimating how much money you’ll need for retirement and determining how much to save and invest to meet that goal.

Key Factors in Retirement Planning:

- Retirement Expenses: Estimate how much you’ll spend annually during retirement. Consider housing, healthcare, travel, etc.

- Retirement Age: Decide when you plan to retire and how long you expect to live in retirement (e.g., retiring at 65 and living until 85 would mean you need 20 years of savings).

- Income Sources: Account for any Social Security, pensions, or other income sources.

- Expected Return on Investments: Estimate the return on your retirement savings from investments (stocks, bonds, etc.). Historical averages for stock market returns are around 6-7% annually, but more conservative estimates (e.g., 4-5%) are often used for planning.

- Inflation: Consider the impact of inflation on your purchasing power. Average inflation is about 2-3% per year.

Steps to Project Retirement Savings:

Step 1: Calculate the total amount needed for retirement. Multiply your estimated annual expenses by the number of years you plan to live in retirement.

Step 2: Estimate how much you need to save before retirement. Subtract expected income sources like Social Security from your annual retirement expenses.

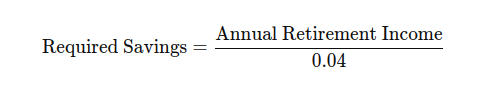

Step 3: Use a retirement savings formula like the 4% rule to estimate how much to save. The 4% rule suggests that you can withdraw 4% of your retirement savings annually without depleting your nest egg.

Example:

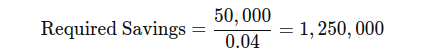

If you estimate needing $50,000 annually in retirement, the 4% rule suggests:

This means you would need $1.25 million in retirement savings.

Step 4: Calculate how much to save each year. You can use retirement calculators to estimate how much to save monthly or annually, factoring in expected returns from investments.

Example Using a Retirement Calculator:

If you’re 30 years old, plan to retire at 65, and want to save $1.25 million:

- Assume your portfolio grows at 6% per year.

- You can calculate how much you need to invest monthly using an online calculator or financial formula to reach your goal.

Adjusting for Inflation:

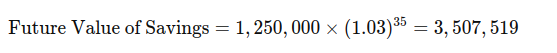

If your target is $1.25 million today, you’ll need more due to inflation. Using a 3% inflation rate over 35 years:

This means you’ll need around $3.5 million in the future to maintain the same purchasing power.

By regularly calculating your ROI and adjusting your retirement contributions based on projections, you can create a solid financial plan that helps secure a comfortable retirement.

FAQs About ROI

What is a good ROI percentage?

A good ROI depends on the type of investment and your financial goals. Generally, an ROI of 7-10% per year is considered solid for stock market investments. For riskier investments, higher returns are often expected. For safer investments like bonds, returns are typically lower (around 2-5%).

How is ROI different from profit?

Profit is the absolute amount of money gained from an investment, while ROI is a percentage that measures the efficiency of the investment relative to its cost. ROI gives a better sense of the profitability relative to the size of the investment.

Can ROI be negative?

Is ROI the same as annualized return?

No, ROI measures the total return over the entire investment period, regardless of duration. Annualized return adjusts the ROI to show the average return per year. If you hold an investment for multiple years, annualized return is a more accurate reflection of performance.

What factors affect ROI?

Several factors affect ROI, including investment fees, taxes, market fluctuations, and the timing of buying and selling assets. Always account for these factors when calculating your net gains or losses.

FAQs About Retirement Projections

How much should I save for retirement?

A common guideline is to aim to save 10-15% of your income annually, but the actual amount depends on your expected retirement expenses, lifestyle, and the age at which you plan to retire. A retirement calculator or financial planner can help customize this amount.

How do I know if I’m on track for retirement?

You can check your progress by comparing your current retirement savings to your projected needs. Use online retirement calculators to estimate how much you should have saved by now based on your age, income, and retirement goals. Regularly assessing this will keep you on track.

What is the 4% rule in retirement?

The 4% rule suggests that retirees can withdraw 4% of their retirement savings annually, adjusted for inflation, without running out of money for at least 30 years. This rule is a general guideline and may need to be adjusted based on personal circumstances and market conditions.

What types of investments should I use for retirement?

Diversifying across a mix of asset types—stocks, bonds, real estate, and possibly index funds or ETFs—can provide balanced growth and security. As you near retirement, it’s wise to gradually shift toward more conservative investments to reduce risk.

How does inflation affect my retirement plan?

Inflation erodes purchasing power over time, meaning that you’ll need more money in the future to maintain the same lifestyle. When planning for retirement, it’s important to adjust savings goals by considering an average inflation rate of 2-3% per year.

How much should I have saved by age 30, 40, 50, and beyond?

A general rule of thumb is to have saved:

By age 30: 1x your annual salary.

By age 40: 3x your annual salary.

By age 50: 6x your annual salary.

By age 60: 8-10x your annual salary.

These numbers are just guidelines, and individual needs may vary based on lifestyle and retirement goals.

Can I retire early?

Retiring early is possible if you save aggressively, invest wisely, and plan carefully. However, you’ll need to ensure you have enough savings to cover more years in retirement and account for things like healthcare costs, which might be higher without employer-provided insurance.

What if I haven’t started saving for retirement yet?

It’s never too late to start saving for retirement. If you’re starting late, consider maximizing contributions to retirement accounts like 401(k)s and IRAs, reducing unnecessary expenses, and investing more aggressively to catch up.