Introduction:

Managing personal finances is more accessible than ever, thanks to the growing number of budgeting apps designed to help you track spending, save money, and achieve your financial goals. With 2024 just around the corner, it’s essential to know which budgeting apps offer the best features, ease of use, and overall value.

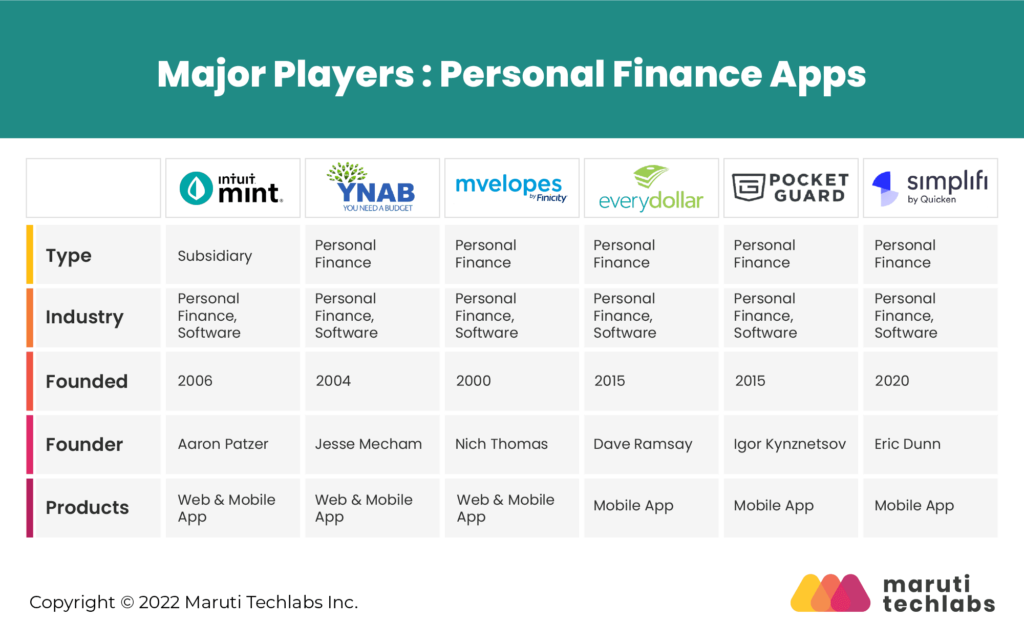

This post will review the top budgeting apps for 2024, comparing their strengths and weaknesses to help you find the right one for your financial needs. Whether you’re looking for simple expense tracking, debt reduction tools, or full-blown financial planning, there’s an app tailored to your situation. We will examine apps like Mint, YNAB (You Need A Budget), PocketGuard, Personal Capital, and Goodbudget to see what makes each one stand out.

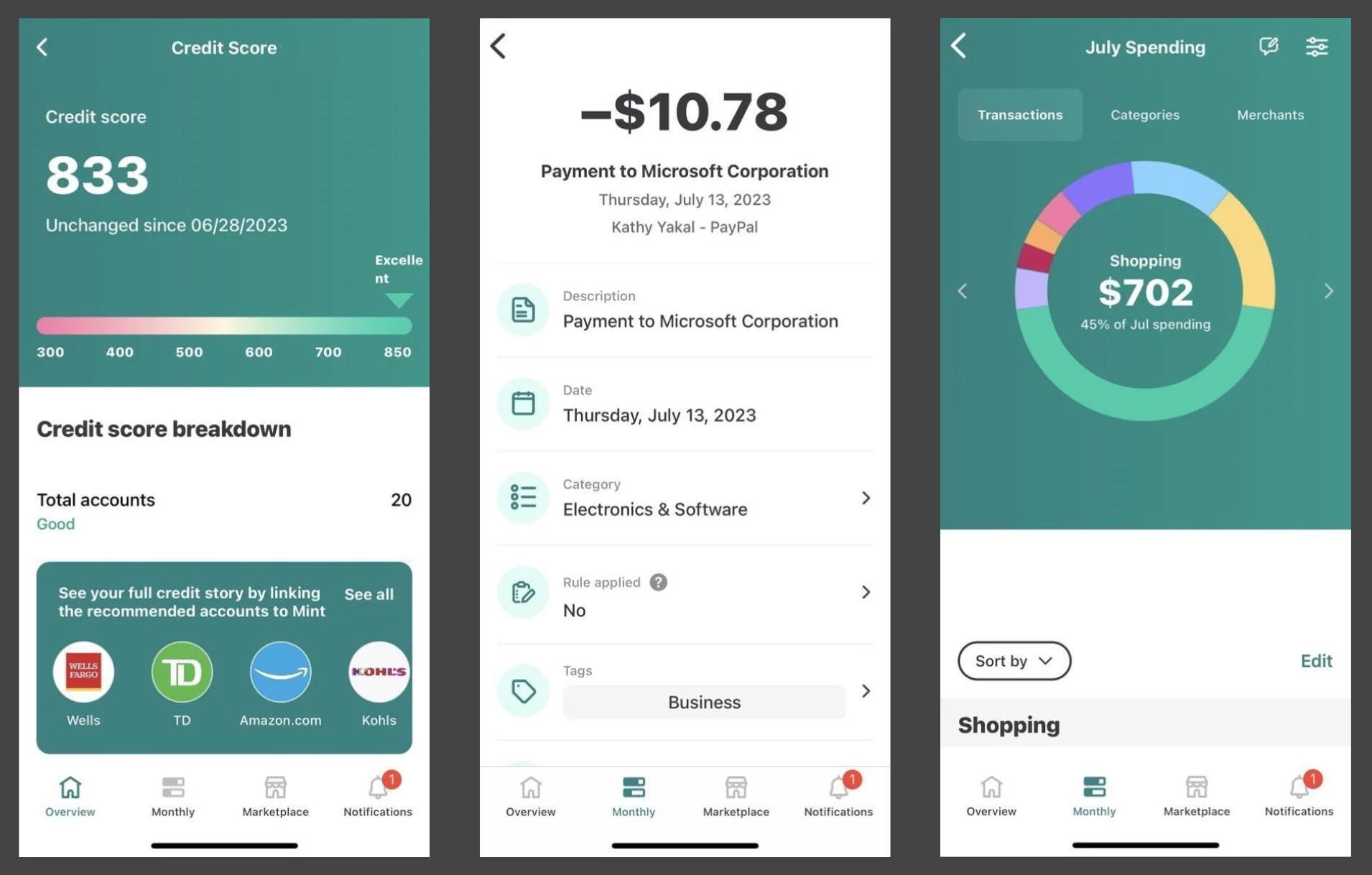

1. Mint: The Best Free All-in-One Budgeting App

Overview:

Mint, by Intuit, is one of the most popular budgeting apps available today, offering an all-in-one solution for tracking your expenses, creating budgets, and monitoring your credit score. Best of all, it’s free to use, making it an excellent option for users who want to manage their finances without spending extra on software.

Key Features:

- Expense Tracking: Automatically categorizes transactions from your linked accounts.

- Budget Creation: Set up budgets for various categories, such as groceries, transportation, and entertainment.

- Credit Score Monitoring: Track your credit score for free within the app.

- Bill Reminders: Get alerts when bills are due to avoid late fees.

Pros:

- Free to use with comprehensive features.

- Easy to link multiple financial accounts.

- Provides a broad overview of your financial health.

Cons:

- Ad-supported, which can be distracting for some users.

- Limited customization options for advanced budgeting.

Best For:

Mint is ideal for individuals looking for a free, user-friendly budgeting app that provides an all-in-one solution for tracking expenses and keeping tabs on their credit score.

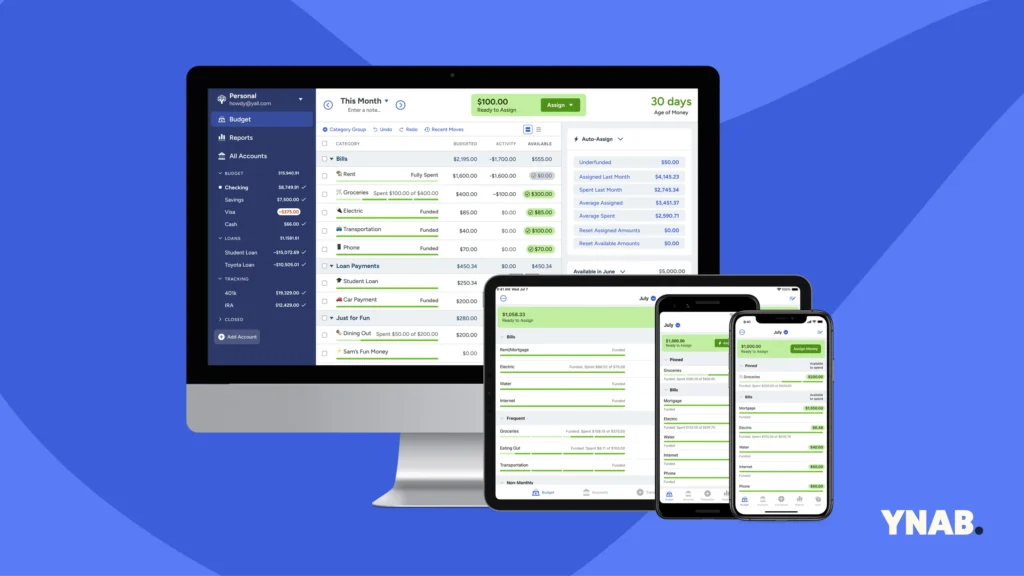

2. YNAB (You Need A Budget): Best for Proactive Budgeting

Overview:

YNAB, short for You Need A Budget, is perfect for individuals who want a more hands-on, proactive approach to managing their money. Unlike other budgeting apps, YNAB operates on the principle of “giving every dollar a job,” meaning you allocate each dollar to a specific purpose, such as bills, savings, or debt repayment. This approach encourages users to take control of their spending and align their money with their financial goals.

Key Features:

- Proactive Budgeting: Allocate every dollar before it’s spent.

- Goal Setting: Set financial goals and track your progress.

- Debt Payoff Assistance: YNAB helps you prioritize debt payments by structuring your budget effectively.

- Comprehensive Reports: Generate detailed reports to see where your money is going.

Pros:

- Encourages active engagement with your budget.

- Great for users focused on getting out of debt or improving financial habits.

- Offers financial education resources and workshops.

Cons:

- Requires a paid subscription ($14.99/month or $99/year).

- Steeper learning curve compared to other apps.

Best For:

YNAB is ideal for users who want to take an active role in managing their finances and need a tool that encourages disciplined budgeting and debt reduction.

3. PocketGuard: Best for Overspending Prevention

Overview:

PocketGuard’s main focus is to prevent overspending by showing users exactly how much they can safely spend. It provides an overview of your income, expenses, and savings goals, helping you understand how much “pocket money” you have after all your bills and savings contributions. PocketGuard simplifies budgeting, making it a great choice for people who tend to overspend or have trouble sticking to a budget.

Key Features:

- In My Pocket Feature: Shows how much disposable income you have after bills, expenses, and savings goals are accounted for.

- Bill Negotiation: Helps you negotiate lower bills through a third-party service.

- Savings Goals: Set savings goals and track your progress in real-time.

- Recurring Subscriptions: Identifies recurring payments and helps you cancel unwanted subscriptions.

Pros:

- Clear visual representation of your spending ability.

- It helps you avoid overspending by showing what’s left after bills.

- Free basic plan available, with premium options for more features.

Cons:

- Fewer customization options than some competitors.

- A premium version is required for full access to all features.

Best For:

PocketGuard is ideal for individuals who tend to overspend and want a simple, straightforward app to show exactly how much they can safely spend.

4. Personal Capital: Best for Wealth Management and Investments

Overview:

While most budgeting apps focus on day-to-day expenses, Personal Capital stands out by offering comprehensive wealth management tools. In addition to tracking your spending, it provides powerful features to help you manage your investments, plan for retirement, and optimize your asset allocation. Personal Capital is a must-have for users who want to go beyond budgeting and dive deep into investment tracking and long-term financial planning.

Key Features:

- Investment Tracking: Monitor your investment accounts and check asset allocation.

- Retirement Planning Tools: Plan for retirement by calculating how much you need to save.

- Net Worth Calculator: Track your total net worth by linking all your financial accounts.

- Budgeting Tools: Includes basic budgeting and expense tracking features.

Pros:

- Ideal for users with a focus on wealth building and retirement planning.

- Provides detailed insights into your investments and financial future.

- Free to use, with additional advisory services available for a fee.

Cons:

- More focused on investments than day-to-day budgeting.

- Can be overwhelming for users primarily looking for basic budgeting tools.

Best For:

Personal Capital is best suited for individuals who are serious about long-term wealth management and need an app that goes beyond basic budgeting to include investment tracking and retirement planning.

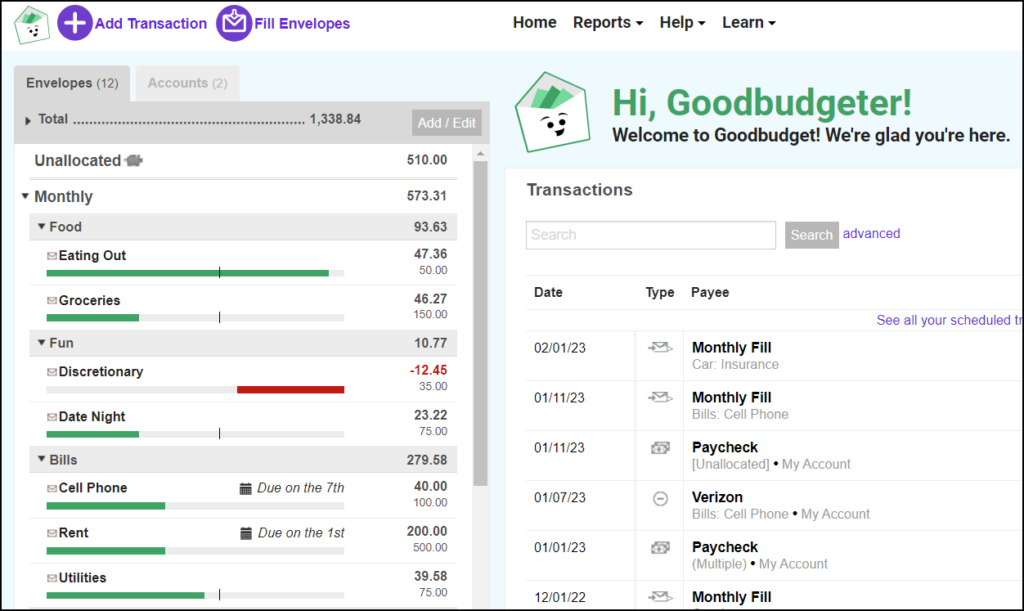

5. Goodbudget: Best for Envelope Budgeting

Overview:

If you’re a fan of the traditional envelope budgeting system, Goodbudget offers a digital version of this classic approach. With Goodbudget, you allocate money to different “envelopes” representing categories like groceries, entertainment, and rent. The app is simple to use and helps you stick to your budget by ensuring you don’t overspend in any one category.

Key Features:

- Envelope Budgeting: Digital envelopes for different spending categories.

- Shared Budgeting: Sync your budget with a partner or family member.

- Expense Tracking: Track your spending against your envelope balances.

- Debt Payoff Tracking: Allocate funds to pay off debts systematically.

Pros:

- Simple, intuitive design for users who prefer the envelope system.

- Great for couples or families who want to budget together.

- Free version available, with premium options for more features.

Cons:

- No automatic syncing with bank accounts; expenses must be entered manually.

- Lacks some of the advanced features of other apps.

Best For:

Goodbudget is perfect for individuals and families who prefer a hands-on approach to budgeting and want to replicate the envelope system in a digital format.

Conclusion:

Choosing the best budgeting app for 2024 depends on your financial goals and personal preferences. Whether you’re looking for a free all-in-one app like Mint, a proactive budgeting tool like YNAB, or a wealth management platform like Personal Capital, there’s an option for every type of budgeter. finance blog.

finance blog

Explore these apps and start taking control of your finances today! Stay tuned to Finance Savvy Spot for more in-depth reviews, financial tips, and tools to help you achieve financial independence.