10 Simple Budgeting Tips to Save More Each Month

Introduction:

Finance blog: Managing your money may seem challenging at times, but it doesn’t have to be. A well-planned budget is the foundation of financial success. These ten simple budgeting tips will help you save more and reduce stress, whether your goal is paying off debt, saving for a big purchase, or just staying on top of your monthly expenses. Let’s dive in!

1. Track Your Spending

To create a good budget, you must first ascertain where your money is being spent. If you prefer a more hands-on approach, keep a spending log or use applications like Mint or YNAB to track your expenses automatically.

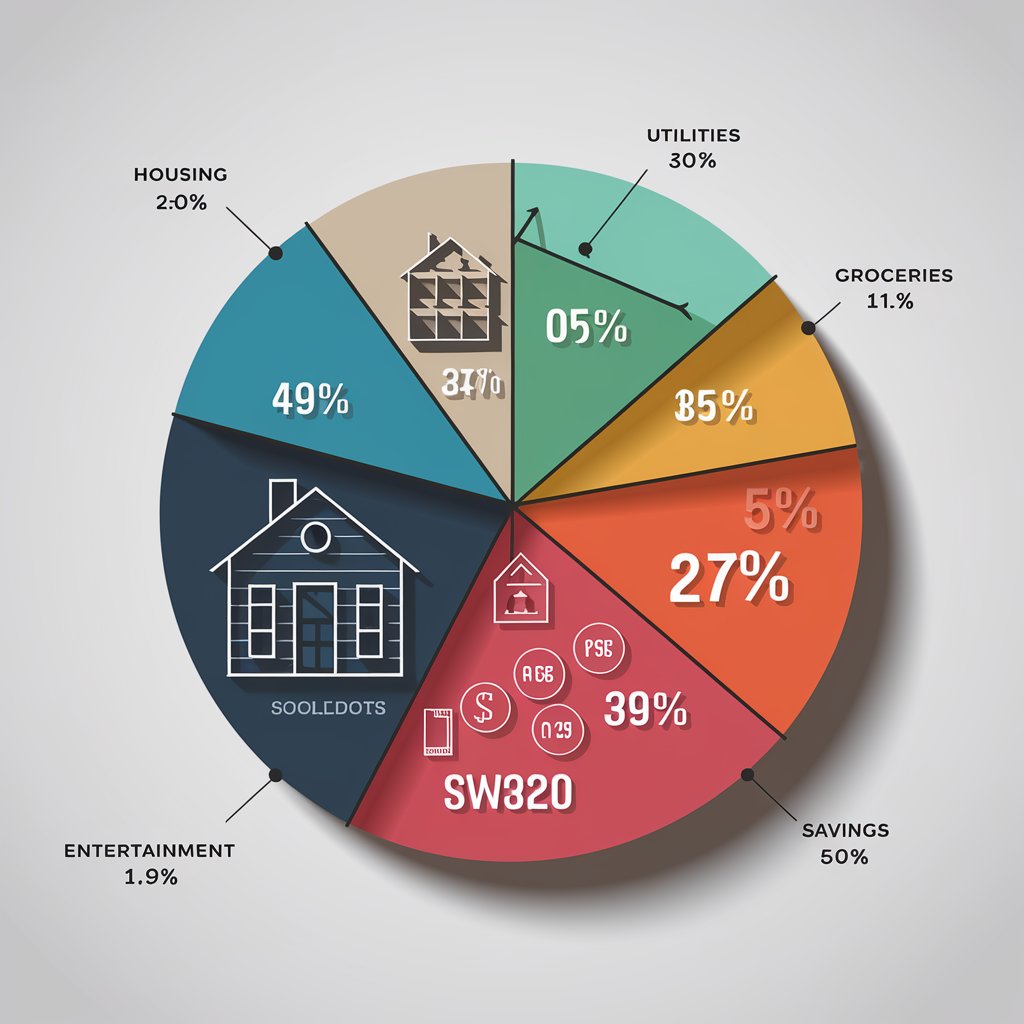

2. Categorize Your Expenses

After you’ve kept track of your expenditures, divide them into necessary and non-necessary categories. This will assist you in identifying areas for savings. Housing, utilities, groceries, entertainment, and savings are examples of common categories.

3. Set Clear Financial Goals

Set specific goals for your budget. Having goals can encourage you to stay within your spending limits, whether they be for vacation savings, an emergency fund, or a down payment on a home.

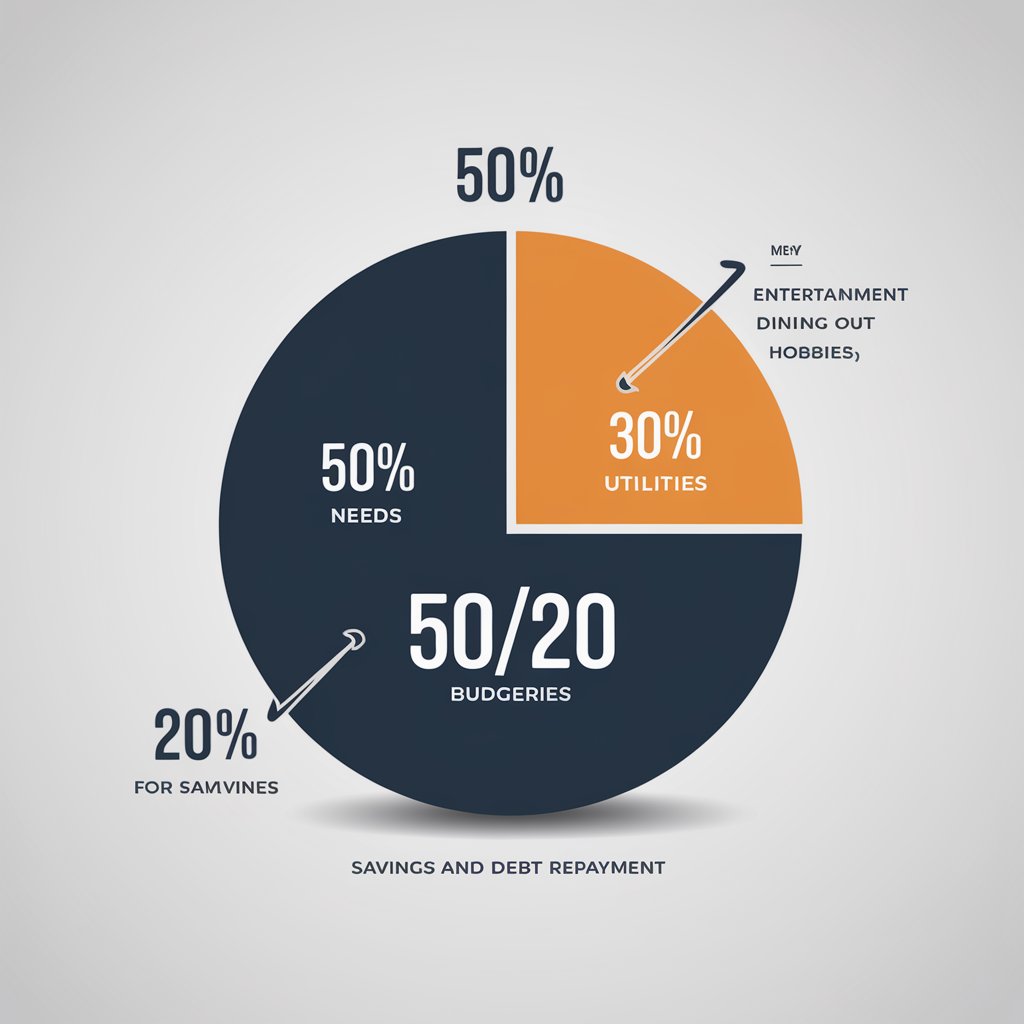

4. Adopt the 50/30/20 Rule

With this well-liked approach to budgeting, you set aside 50% of your money for necessities, 30% for wants, and 20% for debt reduction and savings. It’s an easy method to prioritize your expenditures and manage your finances.

5. Cut Down on Unnecessary Subscriptions

Examine your monthly subscriptions and cancel those that are too expensive or that you are no longer using. Magazines, memberships, and streaming services may fall under this category.

6. Automate Your Savings

Establish monthly automatic transfers to your savings account. This guarantees that you save regularly and without having to worry about it.

7. Shop with a List

Impulse buying can quickly derail your budget. Always shop with a list to ensure you only buy what you need. This applies to both groceries and larger purchases.

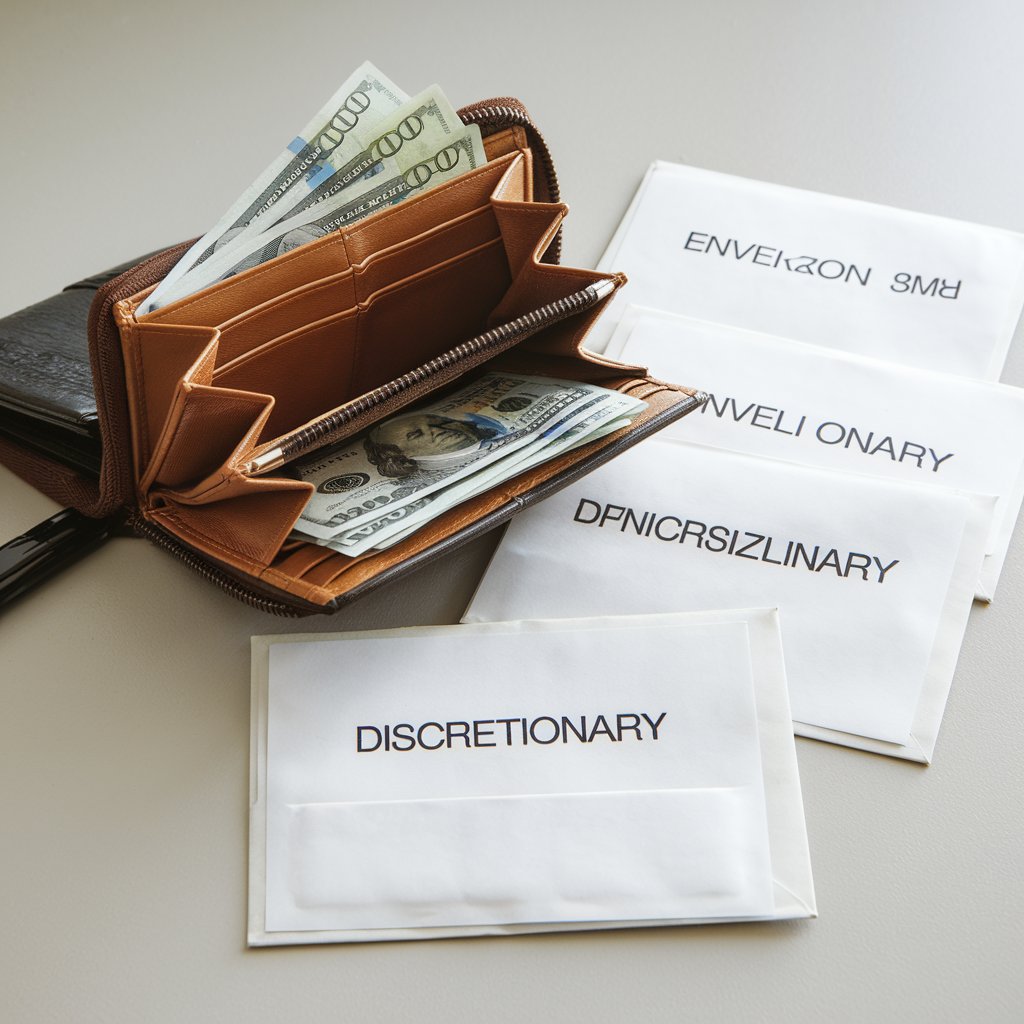

8. Use Cash for Discretionary Spending

Consider using cash for non-essential purchases to avoid overspending. This method, often called the envelope system, helps you stick to your budget by limiting how much you can spend.

9. Review and Adjust Regularly

Your budget isn’t set in stone. Regularly review your spending and adjust your budget as needed to accommodate changes in your income or expenses.

10. Reward Yourself

Budgeting doesn’t have to be all about cutting back. Set aside a small amount for occasional rewards. Treating yourself can keep you motivated to stick to your budget long-term.

Conclusion:

By implementing these 10 simple budgeting tips, you can take control of your finances and start saving more each month. Remember, budgeting is a tool that helps you achieve your financial goals—whether big or small. Start small, stay consistent, and watch your savings grow!

Subscribe to our newsletter for more practical finance tips and exclusive budgeting resources to help you stay on track!